Pellom Value Investments LLC is a private family office registered in the state of Tennessee. Pellom Value Investments LLC is not a registered investment advisor with any governing or regulating body. Nothing in this website should be construed as a public offering or solicitation. We do not accept outside funds for our services. We are not professional investment advisors, nor do we represent ourselves as such.

The information on this site is not intended to be and should not be treated as legal advice, investment advice, or tax advice. You should discuss all recommended tax strategies and other strategies that may be available to you with your professional investment, legal and accounting advisors before implementing them.

Warren Buffett writes his annual Berkshire Hathaway letter directly to his sisters, Doris and Bertie. The aim is to make the letter accessible, informative, and reduces the crutch of too much business jargon. And although they’re smart, Buffett says, his sisters are “not active in business, so they’re not reading about it every day. I pretend that they’ve been away for a year and I’m reporting to them on their investment.”

I think this is a useful exercise worth copying (as are most of Buffett’s traits and decisions), so I aim to write this letter to my wife, Kesney.

Kesney is incredibly smart and diligent. She doesn’t follow the market every day. She doesn’t read financial statements, Morningstar reports, Wall Street Journal articles, etc., and she’s better off because of it. She manages a team of medical professionals each day and is regularly lauded for her and her team’s performance.

Writing to her makes sense because, as is natural in a marriage, no one has entrusted their financial future to me more than she has. And as anyone in a marriage can attest, no one calls me on my B.S. more than she does. I hope writing with her in mind will force me to detail ideas clearly and concisely, while also focusing on the fiduciary requirements of good investment management.

I Made a Mistake

“Love is having to say you're sorry every five minutes.” - John Lennon

Before moving all accounts under management to one strategy, my personal account was truly my only focus from a stock-picking perspective. I am generally OK with more concentration risk in my personal portfolio, but less so for the managed accounts of others. The goal here is to make money safely.

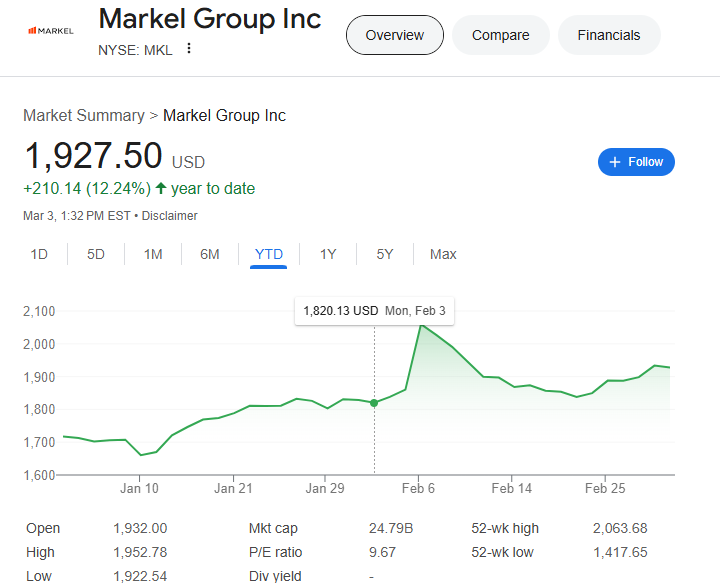

As I transitioned our managed accounts, I looked at my own account and said to myself, “I know you love Markel, but is 20% of the portfolio in one stock really the best path forward?”

I wish I would have stopped there, but I didn’t. On February 3rd, I sold half my Markel shares to drop down to a more reasonable 10% allocation. What an idiotic decision. Markel announced stellar 2024 results the next day and the stock ripped higher as a result.

The stock has come down a bit since then, so in the grand scheme of things not much has been lost, but this is just another reminder to let good companies do the work for you. With a long-term mindset and new cash entering our accounts each month, I should have simply sat on my hands and let the position size take care of itself over time.

New Additions

In the name of diversification (sorry, Markel), and because these companies are undervalued based on historical performance, we added a few new names to our portfolio this quarter. I’ll give a brief description of each company and why we think investors with a long-term focus should consider them. This is a gross over-simplification, but I like companies that have been profitable for a long time while also spitting out cash to shareholders via share buybacks and dividends. I don’t know if these stocks will beat the market over any short, medium, or long term outlook. I think they look cheap compared to historical valuations, and fit in our “forever” time window.

Disclaimer: This is not investment advice. I am not a financial advisor. If a stock I list here goes down, it is because I am an idiot. If a stock I list here goes up, it just means I got lucky.

Sysco Corporation ($SYY)

Sysco Corporation is one of the largest food distribution companies in the world. They supply restaurants, hospitals, schools, and other businesses with food, kitchen supplies, and related products. If you've ever eaten at a restaurant, there's a good chance some of the ingredients came from Sysco.

They are massive, serving over 600,000 customers globally, with operations in the U.S., Canada, and other international markets. Their annual revenue is around $70 billion, making them the biggest player in the food distribution industry.

Sysco continues to grow by buying up smaller competitors and expanding its reach. They dominate the market because they offer a wide range of products, have strong logistics networks, and provide cost-saving deals for businesses. Their size gives them a big advantage, making it harder for smaller distributors to compete.

Sysco went public in 1973. As of November 5, 2024, an investor who bought $1,000 worth of Sysco stock at the IPO would have approximately $1,042,033, representing a compound annual growth rate (CAGR) of about 14.60% over 51 years.

Sysco was once a truly special compounding machine. COVID broke the business model, but our belief, and management’s too, for what it’s worth, is that all supply chain disruptions have been resolved, and the company should start performing to its historical standard.

Sysco is another one of those companies steadily buying back shares and increasing dividends.

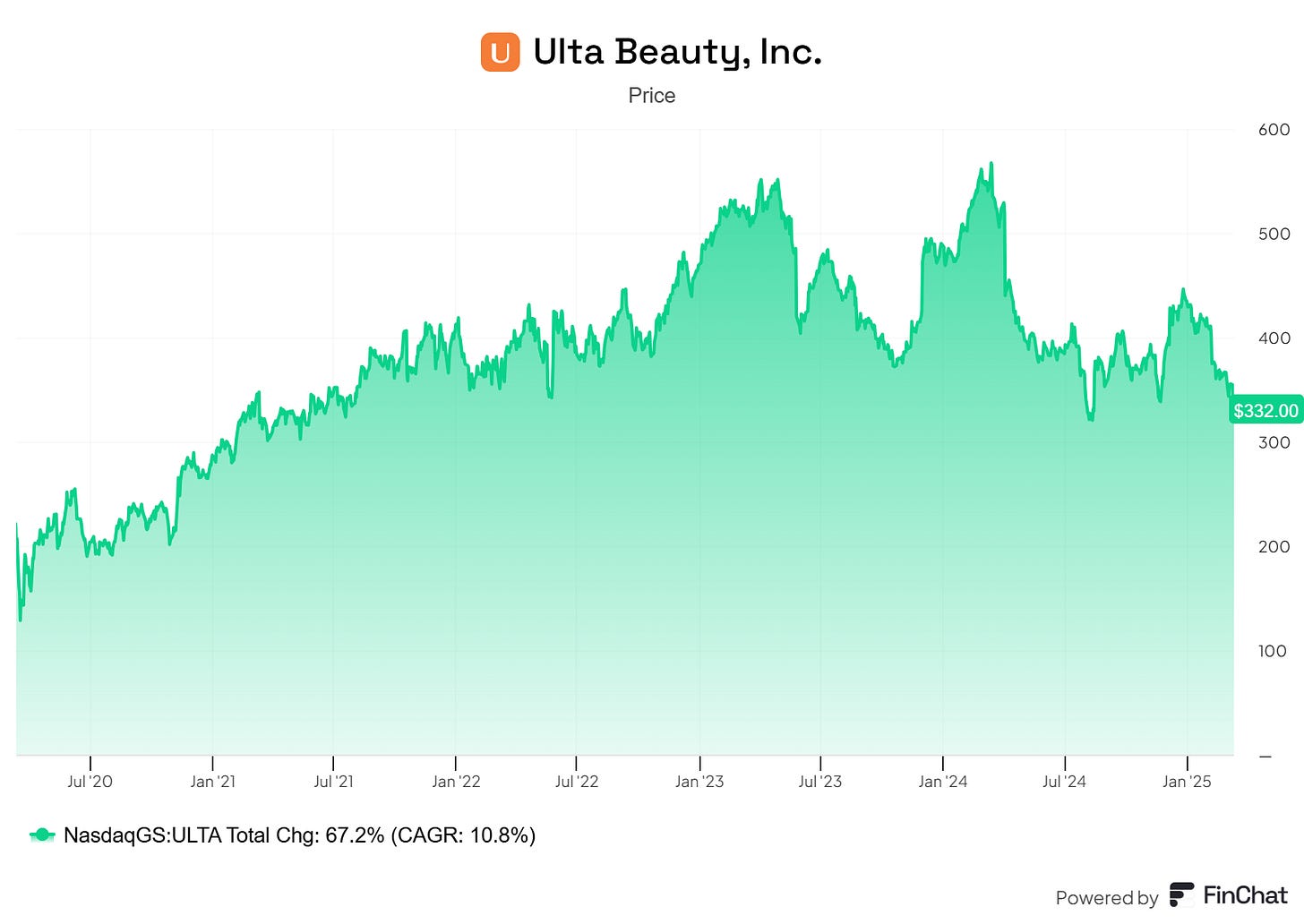

Ulta Beauty ($ULTA)

Ulta Beauty is a major beauty retailer with over 1,400 stores and a strong online presence. It sells cosmetics, skincare, and beauty products and competes with brands like Sephora. Despite being in a competitive industry, Ulta has consistently performed well, even during economic downturns.

Ulta is aggressively buying back its own stock, which increases the value for existing shareholders. Plus, it's currently trading at lower-than-usual valuation levels, making it look like a bargain investment.

Ulta Beauty’s Ultamate Rewards program is one of the most successful customer loyalty programs in retail, with over 44 million active members. It is free to join and operates on a simple points-based system where members earn one point per dollar spent, with higher-tier members earning even more. These points can be redeemed for discounts, starting at 100 points for $3 off, with increasing value as more points accumulate. Additionally, Ulta frequently runs bonus point events that allow members to earn extra points on their purchases, encouraging higher spending.

The program is structured into three tiers based on annual spending. The basic Member tier is available to anyone, offering one point per dollar spent. Customers who spend $500 or more per year reach Platinum status, which increases their earning rate to 1.25 points per dollar and allows their points to never expire. The highest tier, Diamond, is reserved for customers who spend $1,200 or more annually, earning them 1.5 points per dollar as well as free shipping on orders over $25.

Beyond its rewards structure, Ultamate Rewards plays a significant role in Ulta Beauty’s business success. Loyalty members account for approximately 80% of the company’s total sales, demonstrating the effectiveness of the program in driving repeat purchases. Ulta enhances engagement by offering exclusive discounts, free birthday gifts, and early access to sales, all of which encourage customers to remain active participants in the program. Additionally, the company leverages purchase history to provide personalized promotions, further increasing customer spending.

Another strategic advantage of the Ultamate Rewards program is its integration with Ulta Beauty at Target, allowing members to earn points even when shopping at Target locations that carry Ulta products. This partnership expands the reach of the program and strengthens customer retention.

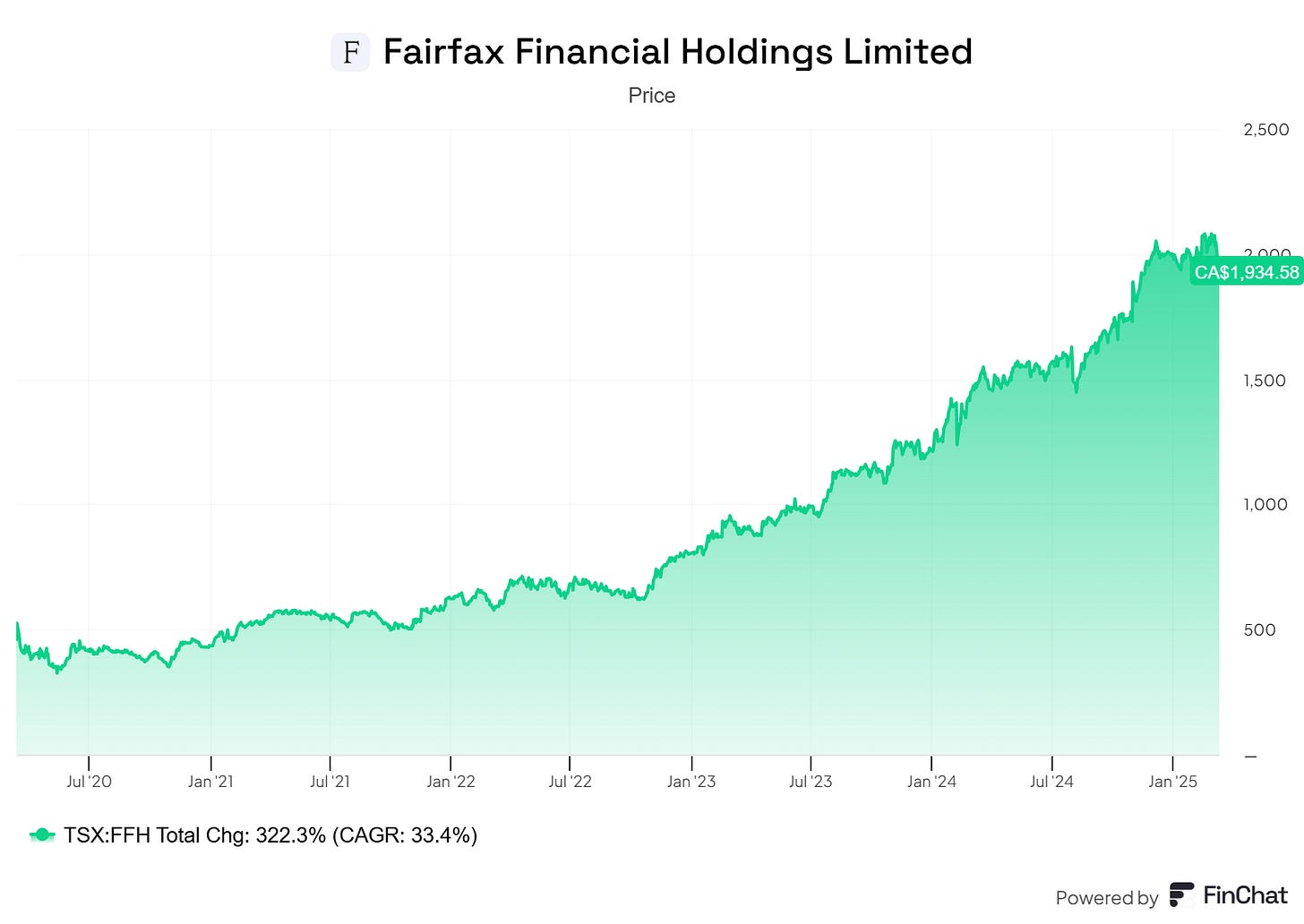

Fairfax Financial ($FFH)

Fairfax Financial has been called Canada’s version of Berkshire Hathaway. It’s an insurance company that takes the money from premiums and invests it wisely to grow wealth over time. The company has a strong history of smart, conservative investing, often thriving during market downturns.

Sticking with the Berkshire comparison. Prem Watsa is often called "Canada’s Warren Buffett" because he runs Fairfax Financial with a focus on long-term value investing. He has a history of making smart bets, especially during market downturns, and prioritizes steady growth over risky short-term gains.

I’m not going to give a thesis that can beat this magnum opus posted by Lars Nordal on the Corner of Berkshire and Fairfax message board. You should read it if you have the time:

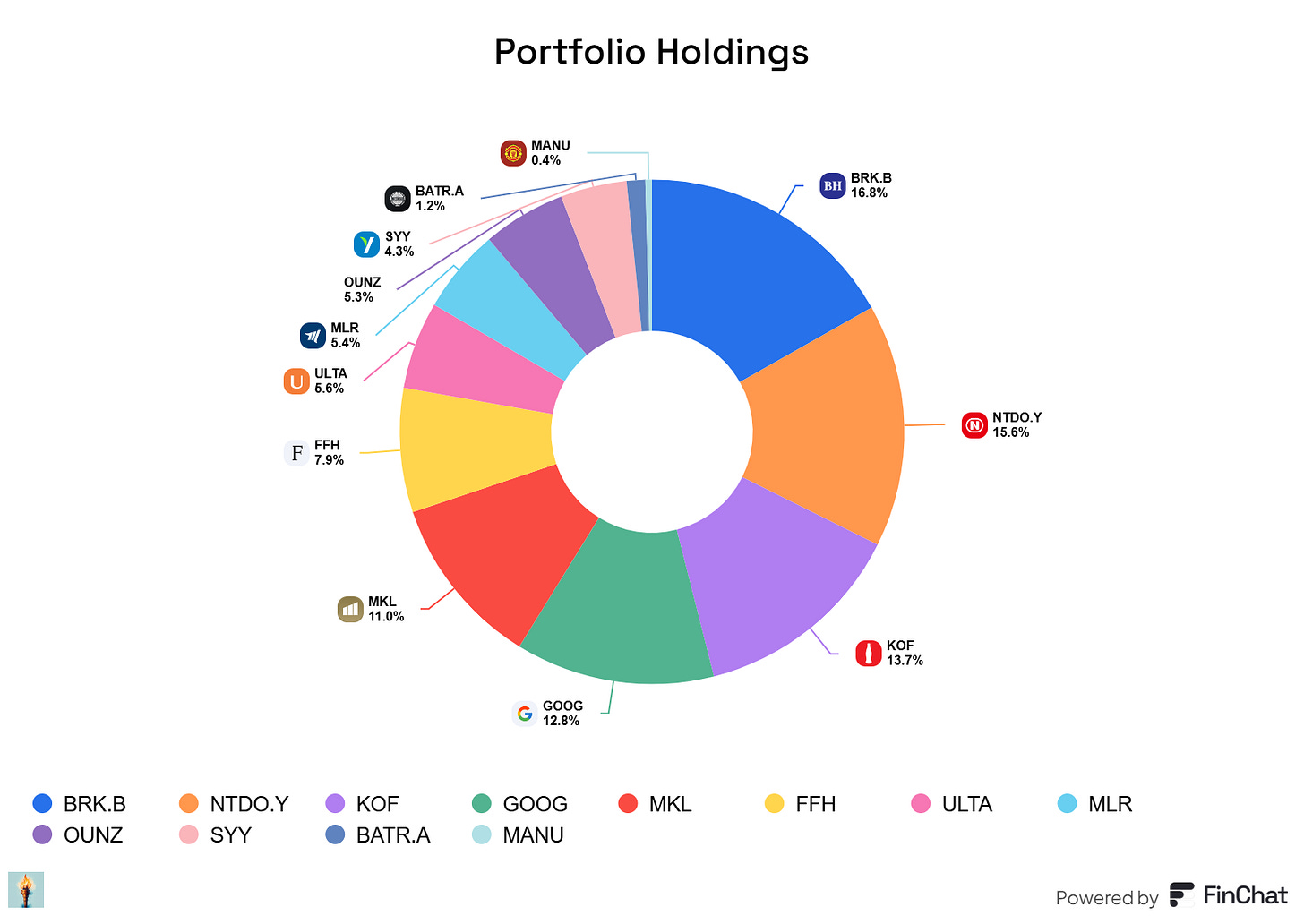

Portfolio Review

It’s fair to say Nintendo, Berkshire and Markel are all overvalued at current prices. I’m certainly not adding to our positions in those companies right now. But, learning the lesson from the Markel situation posted above, I’m not going to sell, either. These are great companies we intend to ride for as long as possible. Their valuations may come down a bit over time (especially in the case of Nintendo, where all the excitement for the Switch 2 has investors front-running the product cycle), but that is of no huge consequence to us as long-term shareholders.

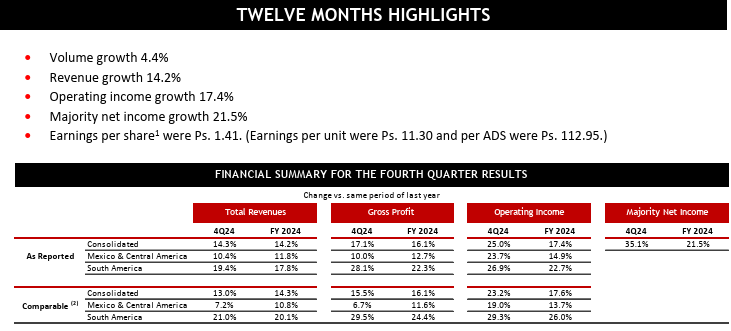

Coca Cola FEMSA had a great 2024, giving us reason to believe the stock remains undervalued:

Miller Industries had a terrible report for Q4 2024 and subsequently cut 2025 projections in half.

“For the twelve months ended December 31, 2024, net sales were $1.26 billion, an increase of 9.0% compared to $1.15 billion in the prior year period. The Company reported net income of $63.5 million, or $5.47 per diluted share for the full year 2024, compared to net income of $58.3 million, or $5.07 per diluted share for the full year 2023, for increases of 8.9% and 7.9%, respectively.

The Company expects to generate $950 million to $1.0 billion in revenue and diluted earnings per share between $2.90-$3.20 for the full year 2025.”

We’ve taken a beating on this investment — down 25% or so when all portfolios are totaled together. However, this is a well run company with conservative management. We’ll stay invested and add to our position over time at these lower prices. Hopefully the next tow-truck and specialty vehicle up-cycle will reward us for our patience.

Lastly, Alphabet’s underperformance compared to the rest of the “Magnificent 7” remains quite puzzling. Folks seem sure the rise of AI means Google searches will become obsolete. This is just my opinion, feel free to make it your own, but I have noticed Google’s AI option at the top of each query has become quite good — or at least just as good as ChatGPT, Perplexity, etc. I think it’s too early to say Alphabet won’t be the ultimate winner in this industry. Add in Gemini and NotebookLM, and I feel it is too early to say Alphabet won’t be a long-term AI winner.

It feels likely there is more pain to come as technology stocks get re-rated indiscriminately, but I genuinely feel that YouTube has the biggest moat in the world. Search, Gemini, NotebookLM, Waymo, Chrome, Android, etc., all thrown in as well as exciting products creating cash flow.

Given the research and development eating up capex, you can run models that get true forward P/E to around 13/14x. A company like this trading around that range is a gift.

Further Reading

Read Warren Buffett’s most recent shareholder letter.

“The American process has not always been pretty – our country has forever had many scoundrels and promoters who seek to take advantage of those who mistakenly trust them ... such malfeasance ... remains in full force today.”

Read Christopher Bloomstran’s letter on Semper Augustus’ portfolio and his valuation of Berkshire Hathaway.

We find similar aspects to the 1998 to 2000 period in today’s market. Beyond the Magnificent Seven, and other tech and now AI beneficiaries, a few dozen of non-tech large company shares are likewise extremely expensive. Costco, Lilly and Walmart (again) are three at top of mind. Just as in the late 1990s, a bifurcation evolved where extremes of valuation exist. Atop the market are several very expensive companies, mostly large U.S.-based; and much of everything else, from mid- and small-capitalization shares to international and emerging markets are at much more reasonable levels. We don’t like characterizing markets with broad-brush generalizations as Mr. Market may be manic in some sectors or geographies but perfectly rational in others. Said differently, mediocre or poor companies deserve low prices while terrific companies are correctly rewarded with premium valuations.

Read Tom Gayner’s (CEO of Markel) most recent shareholder letter.

Redwood trees symbolize enduring growth. They can live for more than a thousand years. The only way to think about them is through a long-term lens. In redwood terms, we’re just getting started. If you ever cut down a redwood tree, you will see a ring marking each year of the tree’s life. Some rings would be thin and some would be thick. They demonstrate resilience and survival. They tell stories of fires, droughts, and endurance through time.

Similarly, the 94 rings of Markel Group tell the story of enduring growth. Along with so many of our colleagues, I have dedicated my life to growing and stewarding the Markel Group. This is a company where people do that. I believe that Markel Group provides a rare environment. People can and do choose to dedicate their lives to the win-win-win philosophy of service to others. With this central idea, we attract colleagues from multiple industries all over the world.

Viva la Mexico

I find myself with a bit of a contrarian streak. As the political demonization of Mexico and Mexican-Americans becomes more mainstream via a certain orange politician, I’d like to share some positive information about our southern neighbors. I found this information insightful, and gives credence to our investment in Coca-Cola FEMSA. (Ulta also plans to build 60+ retail stores in Mexico this year.)

Mexico's economic trajectory has been impressive, with the country ascending to become the 12th largest economy worldwide, according to the International Monetary Fund (IMF). The IMF's nominal GDP forecast places Mexico's economic output at US $1.81 trillion for 2023, surpassing both South Korea and Australia in the global ranking.

PricewaterhouseCoopers envisions Mexico as the world's 7th largest economy by 2050, with nominal GDP expected to reach $2.36 trillion by 2028. Some economists forecast Mexico to become the fifth-largest economy globally by 2050, driven by growth in manufacturing and energy sectors. This expansion is expected to boost the purchasing power of Mexico's middle-class consumers.

In the United States, the Hispanic middle class has been growing faster than other demographic groups. Between 2012 and 2022, the percentage of Hispanic households qualifying as middle class grew from 42% to 48%, compared to the 51% for white households.

The growth of the middle class is a trend across emerging markets. Oxford Economics predicts the middle class population in emerging markets will double over the next decade, expanding from 354 million households in 2024 to 687 million households by 2034.

Sports

We own Manchester United and the Atlanta Braves. While these are very small positions (mostly for fun), we do expect they may be a drag on total portfolio performance. These stocks fluctuate drastically from week-to-week and there is no way to accurately predict where the share prices will be in the future.

With that being said, all of these assets - meaning the teams and organizations - are undervalued by most estimates.

I’ll use Forbes as the reference point here, because it’s the easiest and most straightforward.

Are those numbers to be treated as the gospel truth? I don’t think so. However, if you assume they’re directionally correct, it’s a perfect example of prioritizing being a business owner instead of a stock picker. I think it’s reasonable to expect the valuation of those franchises to increase steadily in the coming years even if their stocks refuse to cooperate.

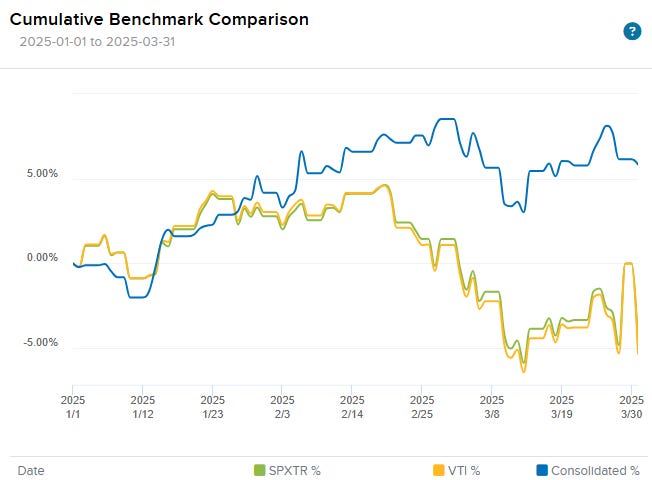

Performance

We finished the quarter up 5.92%. This compares to -4.81% for the S&P 500, and -5.32% for the Vanguard Total Stock Market Index.

Our top performer was Berkshire Hathaway, contributing 2.55% of our total return. Nintendo contributed 2.09%, and Coca-Cola FEMSA contributed 1.73%.

Our bottom performer was Miller Industries, which dropped our total portfolio return by -2.24%. Alphabet was the only other major underperformer, costing us -2.19%.

I’m going to insert another disclaimer here for posterity. We are not financial advisors. Past performance is not a guarantee of future results. Please do your own research and make your own investment decisions.

Ideas Worth Sharing

“I am trying to teach my mind to bear the long, slow growth of the fields, and to sing of its passing while it waits.”

— Wendell Berry

“There are a couple of little rules of thumb. If it's got a really large commission on it, don't read it, because the chance that somebody who is paying a very high commission will give you a big advantage is very low.”

— Charlie Munger

“Inverse correlation between folks who peddle life advice content on IG/TikTok and people whose lives you actually want to emulate. People worth listening to aren’t desperate for your dopamine in 45 second short-form video chunks.”

— Jack Raines

Books Worth Reading

This is one of the few books Warren Buffett has recommended on record. The Outsiders examines eight CEOs who achieved significantly higher stock returns than their peers and the market by effectively allocating financial and human capital. I enjoyed this book because, in my experience, capital allocation is rarely discussed at the C-suite level. Most CEOs come from sales or operations rather than financial or CFO backgrounds, creating a disconnect between owners and operators on capital decisions. As the book illustrates, these decisions have a major impact on returns. The last chapter is “Radical Rationality.” A great term.

Valley So Low: One Lawyer's Fight for Justice in the Wake of America's Great Coal Catastrophe

“In the mid-1950s, TVA, already the nation's largest power system by output, became the country's largest coal consumer, and the skies over the valley darkened as proof. In Chattanooga, soot blackened men's white shirt collars. In Nashville, boys rode bikes with handkerchiefs tied over their faces to prevent choking on coal smog. On the Cumberland Plateau, pine trees twenty miles from the nearest TVA power plant lost their color. In northeast Alabama, TVA's Widows Creek Fossil Plant sprayed two counties with sulfurous smog in concentrations "that most private industry would not dare," The Nashville Tennessean reported in 1967. Three years later, the federal government ranked three Tennessee cities-Nashville, Chattanooga, and Knoxville—as having some of the country's worst air quality. But, of all the towns forced to endure TVAs pollution, few had it worse than the little hamlet of Kingston.”

Most of the people reading this post are from where I’m from. You should pick-up a copy of this book as soon as possible.

The men and women who cleaned up this place - our hometown - have yet to be wholly compensated, either financially by TVA and Jacobs, or by reputation and respect by a community still not fully aware of the sacrifice paid on their behalf.

The story revolves around SAC Capital Advisors and its founder Steven A. Cohen, who used his hedge fund to become one of the richest people in the United States. Insider trading is rampant in the hedge-fund world, and this book provides an in-depth look of how Cohen and other top-dogs on Wall Street insulate themselves from federal regulators. It is mind-boggling that people regularly invite Cohen to speak at various conferences and ask his opinions of the market. Cohen also owns the Mets. We own (a slightly smaller portion) of the Braves. Natural enemies.

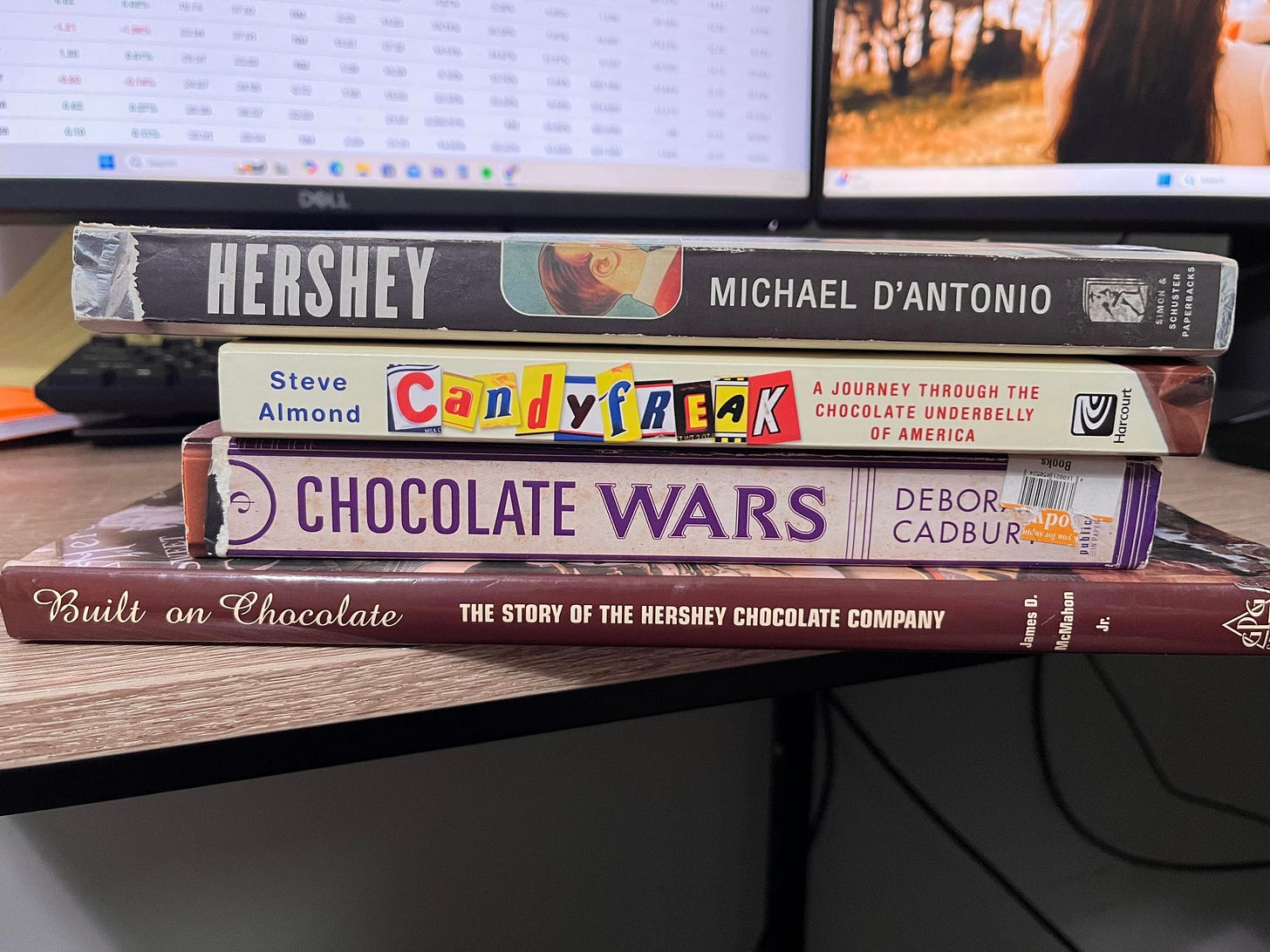

I’ve been researching Hershey as a potential future investment. The next few books have been great resources in understanding the history of the company and the industry.

Built on Chocolate: The Story of the Hershey Chocolate Company by James D. McMahon Jr.

Milton S. Hershey wasn’t just a businessman—he cared about his workers and community. Unlike many industrialists of his time, he supported labor, paid fair wages, and even kept factory construction going during the Great Depression so employees wouldn’t lose their jobs. He set up the Hershey Trust, which still funds the Milton Hershey School, a free boarding school for kids in need. He also built Hershey, Pennsylvania, as more than just a company town, making sure it had affordable housing, parks, and cultural spaces so workers and their families could have a good life.

Both Hershey and Cadbury were founded on the Quaker business idea of, “doing well by doing good.” We’d all be better off if we saw that as our North Star.

Thanks for sticking with it and reading to the end. I appreciate you.

Take it slow,

Tyler

Pellom Value Investments, LLC

Great quarter! And great write-up