Pellom Capital Preservation LLC 2024 Review and 2025 Outlook

I opened a family office in 2024 with no money.

Pellom Capital Preservation LLC is a private family office registered in the state of Tennessee. Pellom Capital Preservation LLC is not a registered investment advisor with any governing or regulating body. Nothing in this website should be construed as a public offering or solicitation. We do not accept outside funds for our services. We are not professional investment advisors, nor do we represent ourselves as such.

The information on this site is not intended to be and should not be treated as legal advice, investment advice, or tax advice. You should discuss all recommended tax strategies and other strategies that may be available to you with your professional investment, legal and accounting advisors before implementing them.

“Family offices” are entities established by wealthy families to manage their wealth and provide other services to family members, such as tax and estate planning services. - Securities and Exchange Commission

I opened a family office in 2024 with no money.

Well, that’s a slight exaggeration. I have an IRA, and my wife has an IRA.

That’s it.

No wealthy ancestors, no mind-boggling inheritance, no six or seven figure salaries… nothing.

My wife and I don’t come from wealthy backgrounds. Far from it, to be honest.

I founded Pellom Capital Preservation LLC to write a different story for future generations.

My aim is to provide high-quality investment advice and management to close family members in an honest effort to build steady retirement income for what I’ll call our first generation, while also passing down both a healthy inheritance and prudent financial habits to our children and grandchildren, the second and third generations.

The goal has never been to make as much personal income as possible. I have a real problem with the traditional investment advisory industry. I believe there is a contradiction in asking people to make good financial decisions while also requiring them to pay you large sales commissions on the front-end, or cumbersome performance fees on the back end. Good advice is important and helpful and worth paying for. Average (to bad) advice only gets in the way of long-term investment growth.

At the most recent Berkshire Hathaway Annual Meeting in May, Warren Buffett was asked why he continues to work given he is 94 years old and one of the richest men in the history of the world. His answer illuminates what I believe motivates me:

“I really enjoy managing money for people who trust me. I don’t have any reason to do it for financial reasons. I’m not running a hedge fund or getting an override or anything. I just like the feeling of being trusted. Charlie felt the same way. That’s a good way to feel in life and it continues to be a good feeling. So, I’m not really looking to change much.”

It is important to me to be trusted. I hope I can continue to foster those feelings of confidence and stability for the rest of my life.

As the disclaimer plainly states above, I am not a registered investment advisor, and nothing written here should be taken as investment advice. I am still “learning while doing” in regard to investment analysis and portfolio management.

I will make mistakes.

My primary focus is risk management and capital preservation. I believe the value investing framework of the aforementioned Warren Buffett, in addition to other successful investors like Tom Gayner, Ben Graham, Howard Marks, Li Lu, Seth Klarman, etc., provides ample opportunity for us to meet our goals. I have no plans to change investment strategy in order to chase performance. I want solid, stable returns over long timeframes.

Our edge over the market is not in information nor intelligence. We do not have enough money to “throw our weight around” and force companies and management teams to bend to our wishes. We can’t move a stock higher simply by buying thousands of shares at a time.

Our edge is making sensible decisions over long periods of time. We can’t aim to be perfect, just “directionally correct,” as Markel CEO Tom Gayner says.

Managed Account Performance

Pellom Capital Preservation Default Portfolio

As a reminder, the intention of this portfolio is to serve as an “all weather” portfolio. What that means, to us anyway, is that it can perform well in all market conditions without chasing performance risk. This portfolio is designed to be held in retirement accounts, for long periods of time, to allow each sector of the portfolio to perform as hedges for others in difference market/business cycles. You can read more about this strategy here: link

Here are the target allocation amounts:

VTI Vanguard Total Stock Market ETF - 30%

BND Vanguard Total Bond Market - 25%

OUNZ VanEck Merk Gold ETF - 20%

BRK.B Berkshire Hathaway - 12.5%

MKL Markel - 12.5%

Performance

This portfolio was up 18.8% in 2024 compared to 24.47% for the S&P 500.

$10,000 invested on January 1, 2024, would be worth $11,884 as of December 31, 2024, which represents a cumulative return of 18.84%. Over the same period, the benchmark would be worth $12,447, which represents a cumulative return of 24.47%.

The maximum drawdown of the portfolio was 2.94% from December 1, 2024, to December 31, 2024. Over the same period maximum drawdown of the benchmark was 4.03% from April 1, 2024 to April 30, 2024. The risk adjusted return of the portfolio, measured by the Sharpe Ratio, was 1.48. Whereas the Sharpe ratio of the benchmark was 1.62.

We plan to rebalance to our target allocations on the first trading day of the year.

529/College Savings Accounts

We manage 529 college savings accounts for six children whose ages range from three to fourteen years old. While I won’t take credit for the impressive return in these accounts in 2024 (529 investments are limited by law to mutual funds and ETFs, and 2024 was a great year for stocks), I share this as proof of concept regarding the power of compounding and dollar cost averaging.

Tyler’s Personal Portfolio Performance

After reading Conor Mac’s great Substack piece (Why are You Looking at Everyone Else?) from November, I’ve been thinking about the best way to share my portfolio and my portfolio results.

I want to be as transparent as possible with this process. Oftentimes I see others share their eye-popping returns daily, weekly, monthly, etc., and it makes me feel inferior. The investment social media bubble is a small one. Much like your Instagram algorithm feeds you people who are better looking, skinnier, and richer, I have found Substack and other platforms seem to promote outlandish content and outlier results.

Because I believe companies and corporations often have reason to lie to you (even under audit) so that you will invest in them, I certainly believe there are plenty of investment managers/advisors/writers painting the rosiest picture of their returns they can muster. These people are influencers masquerading as investors. They are selling themselves to you - their success, their intellect, their process. Their follower counts, likes, shares, etc., are how they measure their value.

Anyone motivated by those things has no need to tell you the truth when things aren’t working out.

I share my portfolio here to disabuse anyone of the notion I might also be gaming the system in some way. I have a modest amount of money that I invest for myself in individual stocks. These holding are in a Roth IRA. I don’t plan to use the funds in this account for 30 years or more. I try to buy safe companies at reasonable prices, with the idea being to hold them in my portfolio for 5, 10, 15 years or more.

I think of my holdings as different pools of investments. I’ve got two stalwarts I plan to hold forever, a group of “quality” companies I believe are positioned well for the future and purchased at a reasonable price, and deeply undervalued companies purchased with a large margin of safety. I also have a small allocation in publicly traded sports teams I support.

As always, past performance is not indicative of future results. Any past or future outperformance should be considered a lucky roll of the dice, while any past or future underperformance should be considered proof of my ineptitude.

Here is a screenshot of my portfolio taken directly from Interactive Brokers on 12/31/2024:

This account was opened in June of 2024 (with the family office) and the cost basis of each holding is from that time forward.

Stalwarts

Markel and Berkshire Hathaway

As detailed in the “Default Portfolio” link above, I simply believe in the management teams of these two organizations and wholly appreciate their respective cultures. I’m not overly concerned with valuation here or projected future returns — those things will work themselves out over time. I believe in Warren Buffett, Tom Gayner, and the teams around them.

Quality Value

Alphabet, Coca-Cola Femsa, Fomento Economico, Nintendo, Miller Industries, Ambev

Alphabet's robust financial position, dominance in the digital advertising market, and ongoing investments in emerging technologies like artificial intelligence continue to make it an attractive long-term investment option in the tech sector. I purchased shares on October 15th at $168.53 per share. With a forward P/E ratio under 20 at the time of purchase, the stock was trading at an attractive valuation compared to its historical averages.

Coca-Cola FEMSA and Fomento Económico Mexicano represent a formidable duo in the Latin American beverage and retail market, with a symbiotic relationship that leverages their respective strengths in bottling and distribution.

Coca-Cola FEMSA, 47.9% owned by FEMSA, is the world's largest Coca-Cola bottler by volume, operating in ten countries across Latin America. In 2019, it produced and sold 11.1% of Coca-Cola's global volume, underscoring its significant market presence.

FEMSA, meanwhile, is a diversified powerhouse in the Mexican and Latin American markets. It operates the largest convenience store chain in Mexico, OXXO, with 19,800 locations. The company's total workforce of nearly 300,000 employees across 13 countries in Central and South America demonstrates its substantial regional footprint.

The symbiotic relationship between these entities is evident in their integrated operations. Coca-Cola FEMSA handles the bottling of Coca-Cola products, while FEMSA's extensive retail network, particularly through OXXO stores, provides a robust distribution channel. FEMSA's diverse portfolio, including convenience stores, drugstores, and fuel stations, offers multiple touchpoints for Coca-Cola product sales.

Nintendo's investment thesis centers on its strategic pivot towards leveraging its vast portfolio of legacy intellectual properties while preparing for the launch of its next-generation console, tentatively known as the Switch 2. The company's proven ability to remix decades-old franchises like Mario and Zelda with innovative hardware has consistently driven strong sales and customer engagement. This approach, combined with Nintendo's substantial cash reserves and understated investments in ventures like the Pokemon Company, provides a compelling growth opportunity with considerable downside protection. As Nintendo shifts towards a higher gross margin model and explores new entertainment formats, such as movies based on its IP, the company is well-positioned for long-term capital appreciation and sustained profitability.

Miller Industries is the largest manufacturer of towing and recovery equipment in the United States, specializing in outfitting truck chassis with tow truck bodies. The company benefits from increasing demand for tow trucks, driven by the rising average age of vehicles on U.S. roads, which reached 12.6 years in 2024. Miller maintains a strong financial position with a debt-averse strategy, solid liquidity ratios, and current assets that significantly exceed total liabilities. While the company recently borrowed to support growth and expansion plans, its financial discipline stands out in the automotive sector. With a P/E ratio of 11, near a ten-year low, the stock appears undervalued given its market leadership and financial stability.

Ambev is the largest brewer in Latin America and the Caribbean and is Anheuser-Busch InBev's subsidiary in the region. It produces, distributes, and sells beer and PepsiCo products in Brazil and other Latin American countries and owns Argentina's largest brewer, Quinsa. The company’s financial health remains robust, with a net cash position for over a decade and a low debt/EBITDA ratio of 0.14 in 2023. AmBev benefits from a wide economic moat through cost advantages and strong market shares across Latin America, with opportunities for growth in premiumization and volume.

Deep Value

Ingles Markets, Blue Bird Corp, Currency Exchange International, Exor NV

I wrote about Ingles Markets in June, and thought I did a good job of explaining how management was masking the company's true value, but it turns out I was just scratching the surface. I highly recommend reading these more detailed reports from Gwen Hofmeyr at Maiden Financial and James Emanuel at Rock and Turner.

Blue Bird Corporation is a leading American school bus manufacturer, uniquely positioned as the only major U.S. supplier producing both chassis and body exclusively for school buses. The company has strengthened its market position through strategic investments in factories and lean process engineering, resulting in improved margins. In Q3 2024, despite increased costs, BLBD's gross profit rose 52% year-over-year to $69.4 million, with adjusted EBITDA reaching $48.2 million at a 14.5% margin. The company's financial health is robust, with $232 million in liquidity and near-zero net debt. Blue Bird's future growth prospects are promising, driven by an aging U.S. school bus fleet and supportive regulatory environment. The company's preliminary FY 2024 results show a 19% revenue increase to $1.35 billion, with electric bus sales growing 30%. Blue Bird has also expanded into the Class 6 commercial chassis market, targeting the growing urban delivery sector. For FY2025, Blue Bird has increased its guidance, projecting revenue of $1.4-1.5 billion and adjusted EBITDA of $190-210 million, with a long-term outlook of 15%+ adjusted EBITDA margin on ~$2 billion in revenue.

Currency Exchange International is a fun one. Currently trading at a market cap of $107M. As of last reported quarterly filings, the company has $126M in cash on the balance sheet. That makes some sense given the business operations - currency exchange - but what it also means is if you invest in the company, you are getting future operational income for free. I worked with CXI in a prior banking role. Their system is simple to use, the fees for both client and customer are reasonable, and deliveries were never delayed.

Exor NV is a diversified investment holding company with a portfolio spanning luxury, technology, and healthcare sectors. The company's investments are divided into public, private, and early-stage ventures through Exor Ventures. Its public holdings include significant stakes in Ferrari (24.2%), Stellantis (14.4%), CNH Industrial (26.9%), and recently acquired Royal Philips (15%). Exor's focus on luxury is exemplified by its ownership of Ferrari, the top luxury car brand, and Christian Louboutin, a leader in high-end footwear. In healthcare, Exor's investments include Philips, Merieux (clinical diagnostics), and Lifenet Healthcare (hospital management). The company also holds a majority stake (63.8%) in Juventus football club. Exor's market capitalization of $20.7 billion represents a substantial discount to its estimated gross asset value of $35-37 billion.

Sports

Madison Square Garden Entertainment, Madison Square Garden Sports, Atlanta Braves Holdings

As these holdings represent less than one percent of my portfolio, I don’t believe there is much to discuss. I am a New York Knicks and Atlanta Braves fan, and the opportunity to own a slice of each is a fun quirk of both being publicly listed.

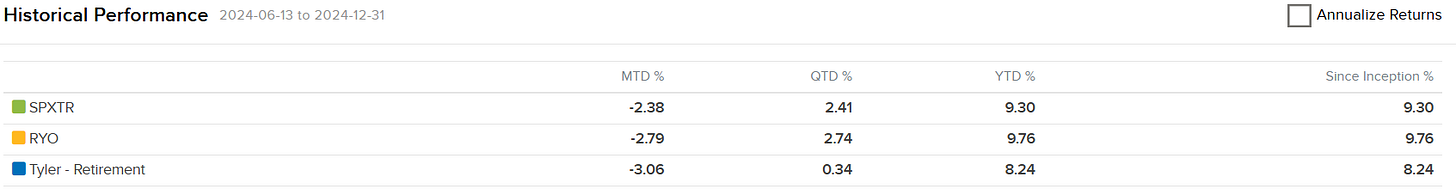

Performance

All told, my personal portfolio was up 8.24% since account inception, compared to 9.30% for the S&P 500 and 9.76% for the Russell 1000. A slight underperformance, however, I’m happy to be close to the S&P given the monster returns the largest tech companies produced this year.

Although I feel the market as a whole is overvalued, I am struggling about how best to capitalize on said overvaluation. Theoretically, it makes sense to sell stocks and hold cash, but I don’t think that’s the best strategy in an IRA with capital earmarked for 30+ years from now. I think it makes sense to buy undervalued companies and stay nearly 100% invested at all times.

I feel comfortable with my portfolio as currently constructed and don’t anticipate making any major changes in 2025. I will continue to add to my current holdings each month and look for any bargains the market produces. I believe the market is priced for perfection, with my personal portfolio priced for mediocrity. (Hopefully there’s some mean reversion in 2025!)

Plans for 2025 and Beyond

I’m not shy about the fact I am still a novice in the investment management/business analysis industry. I am addressing that, slowly but surely, through a mix of traditional education and self-education.

I completed my bachelor’s degree at West Virginia University in December. It was a long and winding road filled with many stops and starts, but it’s gratifying to finally be able to check that box.

I will be pursuing an MBA at Tennessee Wesleyan University, in an accelerated format, beginning in January. Because this accelerated format will be taxing from an intellectual standpoint and require a large portion of my “free” time, I plan to spend less time on social media and Substack in 2025. Ultimately, I hope this forces me to check my portfolio less frequently as well.

I’ve battled internally about how I want to identify myself in the context of an investment management career. Ultimately, I’ve decided I have no interest in being a writer or influencer and instead would prefer to “do the work” of investment/business analysis without chasing Substack subscribers and social media followers. If those things come naturally, fine, but my responsibility is to those who have entrusted me with their hard-earned capital.

In addition to my business school studies, I also have an imposing to-be-read stack to work through over the next 12 months:

Ideas Worth Sharing

“This is the true joy in life, the being used for a purpose recognized by yourself as a mighty one; the being a force of nature instead of a feverish, selfish little clod of ailments and grievances complaining that the world will not devote itself to making you happy.” - George Bernard Shaw

“Try not to become a man of success. Rather become a man of value.” - Albert Einstein

“One-fifth of the people are against everything all the time.” - Robert F. Kennedy

“You choose what kind of human being you're going to be, and then other people choose whether they'll associate with you or not.” - Warren Buffett

I read many good books this year, but I’ll single-out a few as great and worth your time:

The Barn: The Secret History of a Murder in Mississippi by Wright Thompson

“The Barn" by Wright Thompson explores the brutal murder of Emmett Till in Mississippi, delving into the complex history and culture of the Delta region that fostered such racial violence. I recommend the audiobook here. Wright Thompson’s southern drawl adds a haunting aura to this heavy work. It reminds you the past ain’t the past.

The First American: The Life and Times of Benjamin Franklin by H.W. Brands

"The First American" by H.W. Brands offers a comprehensive biography of Benjamin Franklin, portraying him as a multifaceted Renaissance man whose ingenuity and wisdom played a crucial role in shaping the United States.

The Power Broker: Robert Moses and the Fall of New York by Robert A. Caro

"The Power Broker" by Robert A. Caro chronicles the life of Robert Moses and his profound impact on New York City's urban development, revealing the complexities of power and its effects on a metropolis. Everyone who has read it says this is the greatest biography of all time. They are underselling it.

"The Myth of the Rational Market" by Justin Fox examines the rise and fall of the efficient market theory, challenging long-held beliefs about stock market behavior and exploring the emergence of behavioral economics.

Thank you so much for reading. If you’d like to get in touch, feel free to do so here on Substack, or email me at tyler@pellom.org.

We have a chat feature built in as well:

If you’d like to subscribe to the newsletter, you can do so here:

If you’d like to share this post with a friend, click this button:

That’s all for now,

Tyler

Pellom Capital Preservation LLC