New Portfolio Addition - 5/15/2025

Pellom Value Investments LLC is a private family office registered in the state of Tennessee. Pellom Value Investments LLC is not a registered investment advisor with any governing or regulating body. Nothing in this website should be construed as a public offering or solicitation. We do not accept outside funds for our services. We are not professional investment advisors, nor do we represent ourselves as such.

The information on this site is not intended to be and should not be treated as legal advice, investment advice, or tax advice. You should discuss all recommended tax strategies and other strategies that may be available to you with your professional investment, legal and accounting advisors before implementing them.

Gruma, S.A.B. de C.V. BMV - $GRUMA B

Gruma, S.A.B. de C.V., founded in 1949 and headquartered in San Pedro Garza García, Mexico, is one of the world's leading producers of tortillas and nixtamalized corn flour. The company operates globally, with a significant presence in the United States, Mexico, Central America, Europe, Asia, and Oceania. While based in Mexico, Gruma's geographical diversification allows it to mitigate business risk and cash flow volatility, and its significant operations in the U.S. provide access to hard-currency revenue and EBITDA. The company employs approximately 25,000 people and operates 75 plants. As a holding company, Gruma's main assets are the shares of its subsidiaries, which include Gruma USA, GIMSA, Gruma Europe, and Gruma Centroamerica, among others.

In Mexico, Gruma's largest business is the manufacture of nixtamalized corn flour through its subsidiary GIMSA (Grupo Industrial Maseca, S.A. de C.V.). GIMSA holds a dominant position in this market, with approximately 74% market share in the sale of nixtamalized corn flour, which is four times larger than its closest competitor. Nixtamalized corn flour is a key ingredient in tortillas, a staple of the Mexican diet.

This entrenched position, coupled with minimal capital expenditure needs in this segment compared to its contribution to free cash flow, makes GIMSA an underappreciated cash flow machine. GIMSA can consistently grow its business in tandem with inflation in Mexico, which has ranged from ~3-6% over the past five years. This allows Gruma to generate significant free cash flow from GIMSA and invest it in regions expected to be the next geographies for growth, such as the United States.

The United States is a far more important market to Gruma than Mexico, generating over half of sales and roughly two-thirds of EBITDA. Gruma USA operates primarily through its Mission Foods division (tortillas and related products) and Azteca Milling (nixtamalized corn flour). Gruma USA is considered one of the main producers of tortillas and related products, as well as nixtamalized corn flour in the U.S.. Its Mission Foods brand is a "crown jewel" asset that has helped Gruma achieve an estimated ~49% market share in U.S. hard/soft tortillas and taco kits sales.

Growth in the U.S. market is driven by secular tailwinds such as the growing Hispanic population, the proliferation of Mexican cuisine, increased cooking at home, growing interest in tortillas and wraps in non-traditional markets, and consumer demand for higher-margin "healthier for you" eating options. Gruma's "Better for You" SKU line has been evolving favorably and in line with historic growth, supported by healthy tortilla retail growth.

Gruma's management is experienced and shareholder-friendly, with the founding family owning approximately 47% of outstanding shares. The company is focused on the long term, innovation, and consistently improving operations.

Gruma has actively repurchased its shares since May 2018, reducing total shares outstanding by about 16% as of May 2025.

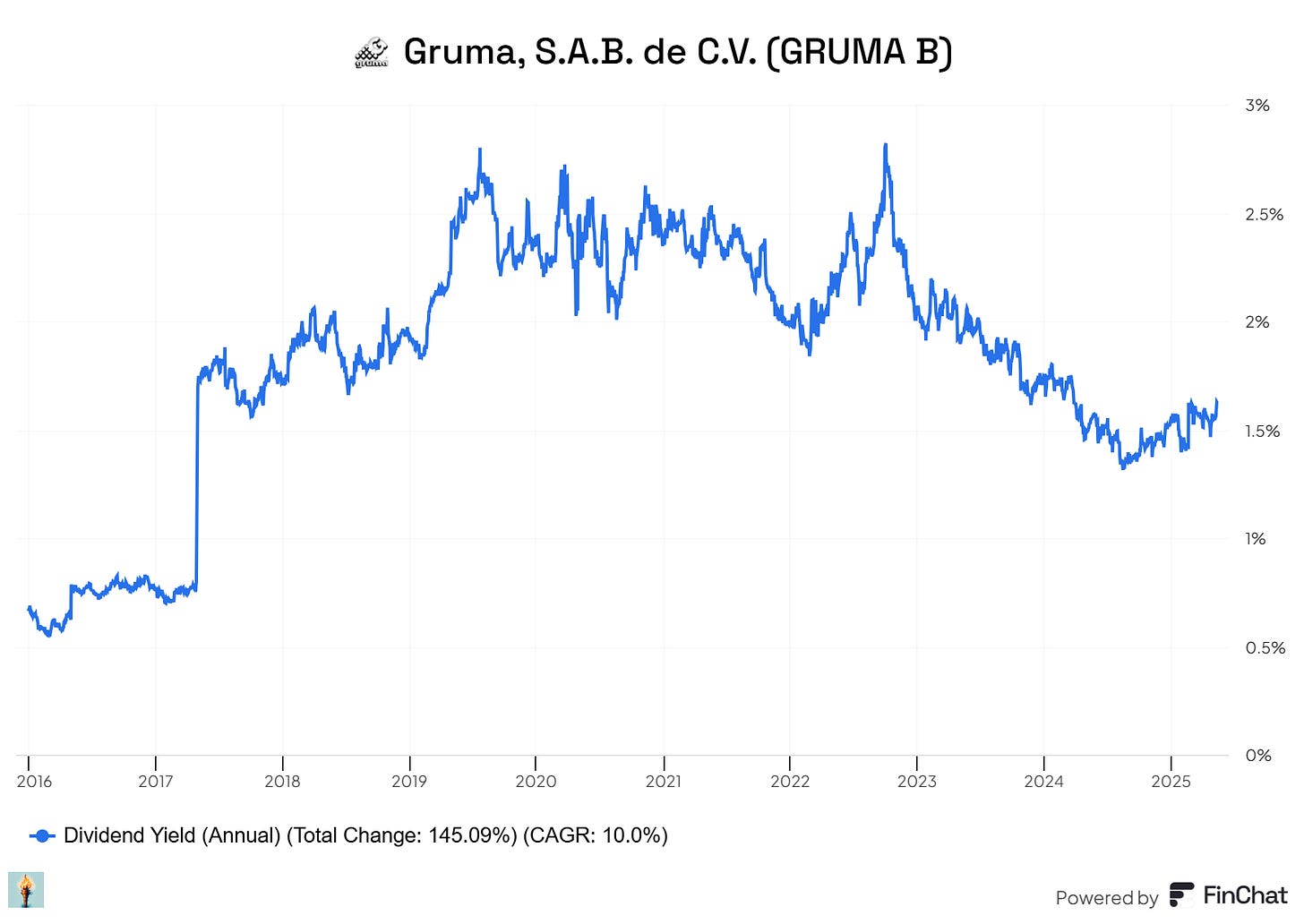

The company has also grown its dividends per share at a 10% CAGR since 2016.

Capital management objectives include maintaining a flexible capital structure, reducing the cost of capital, protecting the company's ability to continue as a going concern, and providing sustainable returns for shareholders.

The company has focused on operational improvements and leveraging prior capital expenditure investments, which has helped offset the pressure from rising corn prices, a significant component of Cost of Goods Sold (COGS). COGS decreased by 10% in 1Q25 compared to 1Q24 due to efficiencies in the US, GIMSA, and Central America.

While risks such as potential antitrust actions in Mexico, increasing competition in the U.S. from players like PepsiCo, volatility in raw material costs, currency fluctuations, and general economic uncertainty exist, Gruma's diversified global footprint, strong market positions, operational discipline, and focus on shareholder value make it an attractive consideration. The company's track record of successfully navigating volatile environments positions it firmly to face future challenges.