Pellom Value Investments LLC is a private family office registered in the state of Tennessee. Pellom Value Investments LLC is not a registered investment advisor with any governing or regulating body. Nothing in this website should be construed as a public offering or solicitation. We do not accept outside funds for our services. We are not professional investment advisors, nor do we represent ourselves as such.

The information on this site is not intended to be and should not be treated as legal advice, investment advice, or tax advice. You should discuss all recommended tax strategies and other strategies that may be available to you with your professional investment, legal and accounting advisors before implementing them.

I thought it would be beneficial to write a quick note this morning providing context for the recent market sell-off. Hopefully, by providing some historical information, it will help us prepare for what is likely to be a painful period for US investors.

Most folks are not buyers and sellers of individual stocks. Instead, you are likely to hold a broad basket of index funds in your 401k at work or your individual retirement account. The core of most 401k offerings is an S&P 500 index fund.

An S&P 500 index fund is a type of investment fund designed to replicate the performance of the S&P 500 Index, which tracks the stock prices of 500 leading U.S. companies. These funds aim to provide investors with broad exposure to the U.S. stock market, focusing on large-cap companies across various sectors. You likely own it via a Vanguard mutual fund or ETF. Low fees, broad diversification, it is a great product.

If you’ve logged in with your 401k provider recently, or consumed any financial news, you’ll know the market has been “crashing” this year. The S&P 500 index has been down roughly 15%.

It’s not necessarily helpful to get into the reason(s) why this is happening — politics and economics can obscure good financial/investing decisions.

However, it’s important to know that your investments are likely to continue to go lower. Here’s why:

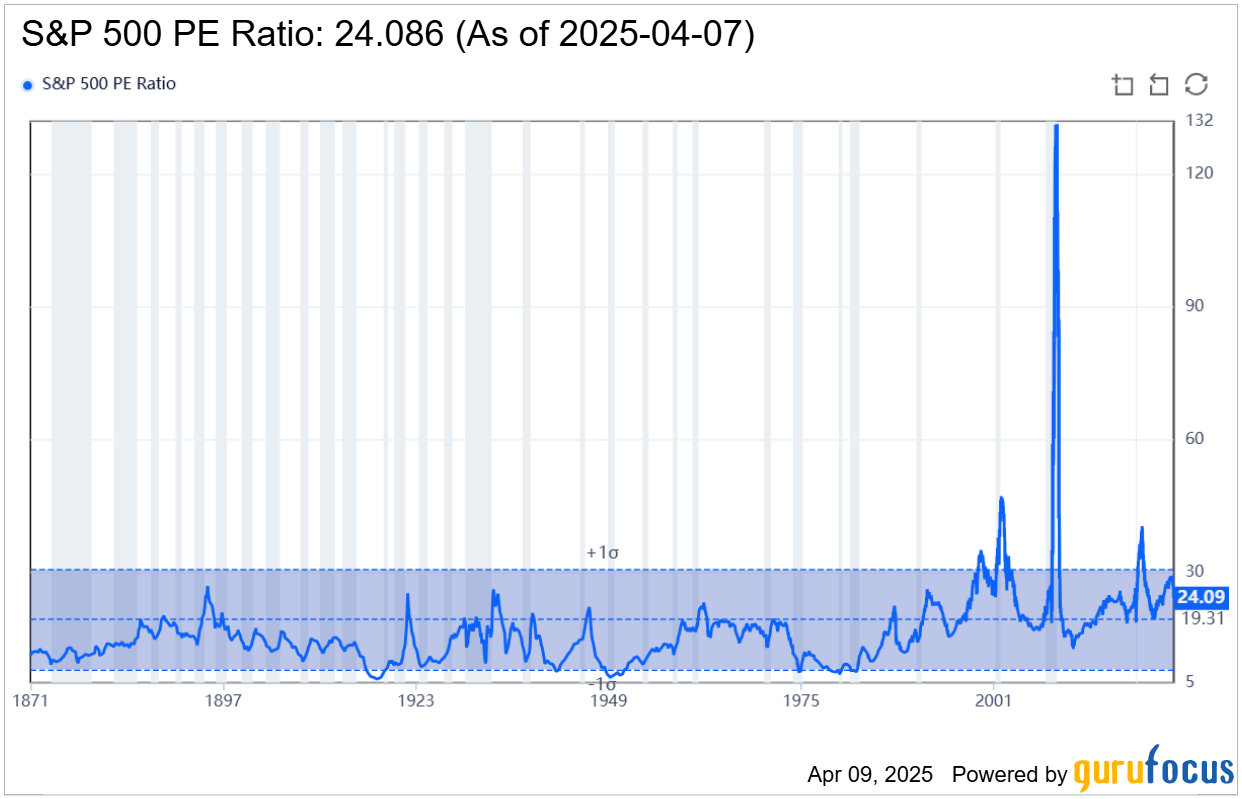

As you’ll see in the chart above, the S&P 500 is currently trading at a 24.09 price-to-earnings ratio. The Price-to-Earnings (P/E) ratio is a simple way to figure out how expensive or cheap a stock (or a group of stocks, like the S&P 500) is compared to how much money the company is making.

Think of it like this:

The "Price" part is how much people are willing to pay for one share of the stock.

The "Earnings" part is how much profit the company makes for each share.

The P/E ratio tells you how many dollars you're paying for every $1 of profit the company earns.

Example:

Imagine you want to buy a lemonade stand:

The lemonade stand makes $10 in profit per year.

Someone is selling the lemonade stand for $100.

The P/E ratio here would be:

P/E= PriceEarnings = 100/10 = 10P/E

This means you're paying $10 for every $1 of profit the lemonade stand makes.

A high P/E ratio means people are willing to pay more for each dollar of profit. This could mean investors expect the company to grow a lot in the future, but it could also mean the stock is overpriced.

A low P/E ratio means you're paying less for each dollar of profit. This might mean the stock is undervalued, but it could also mean people don’t expect much growth.

You’ll see in the chart provided above the average P/E ratio of the S&P 500 (again, meaning an index of the 500 largest companies in the United States) is 19.31. This is important because it tells us American stocks are still overvalued based on historical standards.

Just to reach the historical average range, your S&P 500 index fund must drop another ~20%.

As you’ll also note in the above chart, if the US economy goes into recession (as many economists are now predicting due to slowing growth and tariff fears), the S&P 500 could trade settle around a 10 P/E (as it did in 2007-2008).

In this scenario, your S&P 500 index fund must drop another 60%.

I share these numbers not to spook you out of the market — far from it. What I hope you can do is calm your nerves and tune out the noise. Nick Maggiuli, author of the great investment book Just Keep Buying, said it best on LinkedIn:

The long-term trajectory of American business is up and to the right.

“In its brief 232 years of existence ... there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America. The babies being born today are the luckiest crop in history.” - Warren Buffett

We might soon be facing one of those “severe interruptions” Uncle Warren talked about it in the quote above. View it as an opportunity to buy America at a discount instead of a reason to panic and store cash under your mattress.

We can’t predict the future, but we can prepare for it and benefit from it.

This, too, shall pass.

Thank you for reading,

Tyler