Pellom Value Investments LLC is a private family office registered in the state of Tennessee. Pellom Value Investments LLC is not a registered investment advisor with any governing or regulating body. Nothing in this website should be construed as a public offering or solicitation. We do not accept outside funds for our services. We are not professional investment advisors, nor do we represent ourselves as such.

The information on this site is not intended to be and should not be treated as legal advice, investment advice, or tax advice. You should discuss all recommended tax strategies and other strategies that may be available to you with your professional investment, legal and accounting advisors before implementing them.

Eagle-eyed readers will notice the name change — Pellom Capital Preservation LLC is now Pellom Value Investments LLC. This change more accurately reflects what I think our value proposition is going forward. More information can be found below if you are interested:

In practice, my strategy is what it has always been: buying good companies at a discount and holding them in our portfolios for as long as possible.

I prefer to invest for the long-term because I believe it is the only edge I have over the market. I am not smarter than the market. I do not have more information. I do not have a large following that will allow me to create value by moving prices in my favor.

I believe the only way to win is by refusing to play the game. I do not need to follow daily stock quotations, to invest in every stock going up or down, or to have an opinion on every economic forecast. I can value a company based on conservative estimates, purchase when I both understand the company well and the price falls below my target, and hold on for dear life as the market tries to shake me out of it.

An old boss described me this way when giving a yearly review: “The great thing about Tyler, and the worst thing about Tyler, is he’s always at a 5 [talking about a scale of 1-10]. He can be having the worst day of his life, running around with his hair on fire, and you won’t know it. On the flip side, he can make a huge sale, help a customer out of a jam, get promoted, etc., and you won’t know that either.”

I have been called aloof, nonchalant, and sometimes worse things, my whole life. The fact is a care deeply about my work, my family, the customer/client sitting in front of me. I wholeheartedly want to make peoples’ lives better.

Partly because of my genetics, and partly because of the way I was raised, it has always been my view that staying under the radar is the best way to get ahead — or to put it more aptly, to survive.

I think this is where I can apply value to investing.

“The most important quality for an investor is temperament, not intellect.” - Warren Buffett

I hold on to this quote for dear life, because I certainly don’t have the intellect of most Wall Street bankers and investors.

I’m certainly not arguing I am a Buffett level investor, nor am I arguing I am a stoic monk who does not let the world around me affect me in any way.

The truth is I am deeply concerned by the political climate in the United States. I am sure the decisions made in Washington today will negatively impact my family, your family, and the stock market, tomorrow.

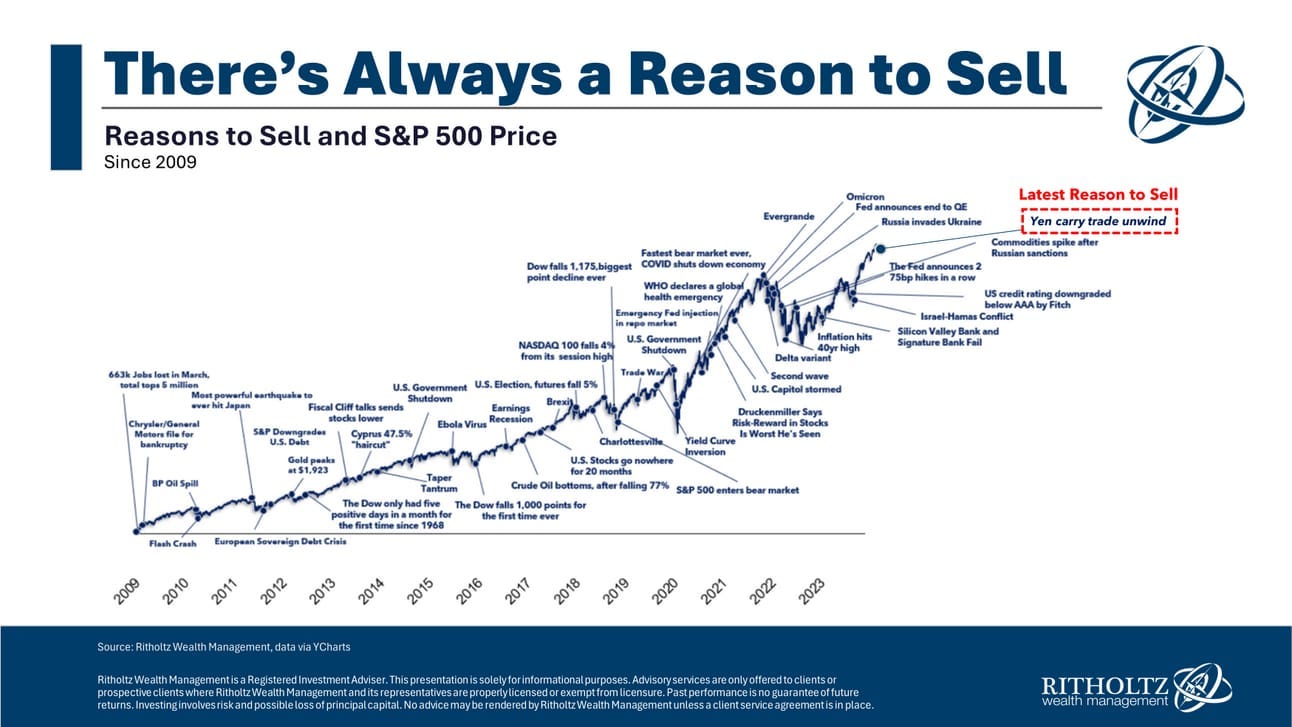

However, although I’m just a poor boy from East Tennessee, I know investing is more successfully done as an optimist than a pessimist. The United States usually figures out its problems - American businesses especially so. This chart from Ritholtz Wealth Management sums it up nicely:

The fact there is always a reason to sell logically means there is always a reason to buy. There is always someone on the other end of the market panicking and selling companies for less than they are worth. By having a long-term approach and adding new cash to our accounts daily, weekly and/or monthly, we are constantly in a position to benefit from said panic.

We all know that Ben Graham quote about the market being a “voting machine” in the short term and a “weighing machine” over the long term. The idea being that daily stock quotations are a popularity contest, but over the long term, just as you cannot fake the weight of something, the market correctly applies the appropriate value to both good and bad companies.

That, to me, is the essence of value investing. On the front end it requires very conservative assumptions about the future prospects of a company and its future growth. Because these assumptions are conservative, it also requires the patience to allow a company to drop into your price range.

There are debates about how much of a discount to true value — or intrinsic value — is required to qualify as a value investment. Ben Graham would tell you 50%. Warren Buffett would tell you it’s better to buy a wonderful company at a fair price than a fair company at a wonderful price. I don’t know what the correct answer is here, but I do believe in the long-term trajectory of wonderful businesses. If you correctly assess the quality of a company, and you have the courage to stick with it through multiple market cycles, the price you paid on the front end becomes increasingly irrelevant.

Because I don’t necessarily believe in my ability to forecast business outcomes through the lens of quality, I find comfort in demanding a margin of safety when purchasing new companies. It doesn’t have to be large, maybe as low as 5-10%, but by doing so, I believe it allows us to hold for a while if the results go against us.

Building on these points, I believe the value investing framework naturally goes hand-in-hand with keeping expenses as low as possible. We’d expect this tact for the companies we buy, why shouldn’t we expect it for ourselves?

Buy things on sale. Keep your fees and expenses low. Repeat for 40 years.

There are too many wolves walking around dressed as sheep, building their own personal fortunes while giving poor and conflicted advice to others. So much of the investing industry is a colossal waste of time and money.

This is the last place I feel I can add value to investing. Pay attention to what you are paying for. Ask for the incentive structures of your money managers. Check the prospectus of the mutual fund you own in your 401k at work.

There is inherent friction in this industry between client and manager. Good financial advice comes in a boring package. It should put you to sleep. It should also be relatively inexpensive!

You should be willing to pay for good financial planning and advice — maybe once a year or once every three to five years. Paying a money manager 1% (or higher based on the product) of your invested assets without clear proof of added value erodes your wealth over time. Here is an example:

Even a 1% fee, over a lifetime of investing, can significantly reduce the value of a portfolio. Using Vanguard data, we know that from 1926 through 2019 an 80% stock and 20% bond portfolio returned 9.7% a year. Let’s imagine we invest $1,000 a month over a 40-year career. Using this savings calculator, we know that the portfolio would grow to about $5.8 million.

Yes, compounding is a beautiful thing.

Let's now assume we pay an advisor 1% of our investments for their services. That's a standard fee in the industry, although you can find less expensive and more expensive advisors. The result is that on an after fee basis, our returns drop from 9.7% to 8.7%. The result is a portfolio of just $4.3 million. The one percent fee cost us about $1.5 million, or 25% of our wealth.

Fees matter.

In the above example, we didn’t consider mutual fund fees. If our advisor invested our money in mutual funds that also charge a 1% expense ratio, our wealth would fall further, down to about $3.2 million.

One percent doesn’t sound like a lot until you have the power of compound interest working against you instead of for you.

Good investment management should be a life-long relationship between advisor and client. How does one, in good-conscience, take $1.5 million (over 40 years in this example) out of their client’s pockets?

It’s a conflict I have yet to wrap my head around.

That’s all for now.

Take it slow,

Tyler